How to Conduct Effective Background Checks in Venture Capital

How to Conduct Effective Background Checks in Venture Capital

Dec 9, 2024

How to Conduct Effective Background Checks in Venture Capital

In venture capital, background checks are essential for making informed investment decisions and avoiding risks. Here's how to do it effectively:

Use AI Tools: Platforms like TRACT analyze vast datasets quickly, covering legal, financial, and professional histories.

Key Checks: Verify founders' credentials, check for legal issues, assess financial stability, and review past ventures.

Steps:

Start with basic screening (identity, employment, education).

Conduct a deep dive into legal, financial, and professional backgrounds.

Tailor checks based on industry, investment stage, and risk profile.

Combine AI with Human Expertise: AI speeds up data collection and analysis, but human judgment is crucial for interpreting findings.

AI-driven tools save time, improve accuracy, and uncover potential risks, while human insights ensure thorough evaluations. This approach helps VCs make smarter, safer investments.

Crucial Early Stage Startup Checks: A VC's Guide to Due Diligence

Key Goals of Background Checks in Venture Capital

Background checks in venture capital combine traditional methods with advanced AI tools to thoroughly assess investment opportunities.

Evaluating Founders and Leadership Teams

Tools like TRACT provide detailed insights into founders' professional history, educational background, industry standing, and leadership approach. By analyzing vast amounts of data quickly and precisely, these platforms help investors confirm vital details while saving time and effort compared to manual checks.

Identifying Potential Risks

Critical risk areas include legal troubles (like lawsuits or regulatory breaches), financial issues (such as bankruptcy or misconduct), reputational concerns (e.g., unethical behavior), and regulatory warnings (like sanctions or watchlist entries). AI solutions like Ferretly scan public records to detect risks that traditional methods might overlook [*].

These AI-driven tools not only simplify risk detection but also lay the groundwork for more thorough due diligence, which will be discussed in the next section.

How AI Tools Improve Background Checks

AI-driven tools have reshaped background checks in venture capital, making the due diligence process faster and more thorough.

What AI Brings to Background Checks

AI tools can sift through massive amounts of data from sources like public records, social media, professional networks, and legal databases. This helps create a more complete picture of potential investments. These systems are also capable of spotting subtle patterns or warning signs that might go unnoticed in traditional checks.

For instance, TRACT uses artificial intelligence to scan millions of records, flagging discrepancies in founders' credentials or connections across various databases [*].

Benefits of AI Tools in Background Checks

AI tools bring several key advantages to venture capital firms:

TRACT: A Leading AI Platform for Background Checks

TRACT is a standout AI-powered platform designed for background checks. It provides venture capitalists with access to over 100 billion records from thousands of sources. Key features include:

Real-time legal data aggregation, covering criminal history, legal filings, and bankruptcy records

Social media analysis spanning more than 100 platforms

Detailed employment and education verification

Secure, in-depth reporting tailored for decision-makers

Interested in learning more about how TRACT can make your due diligence faster and smarter? Schedule a demo.

Steps to Perform Effective Background Checks

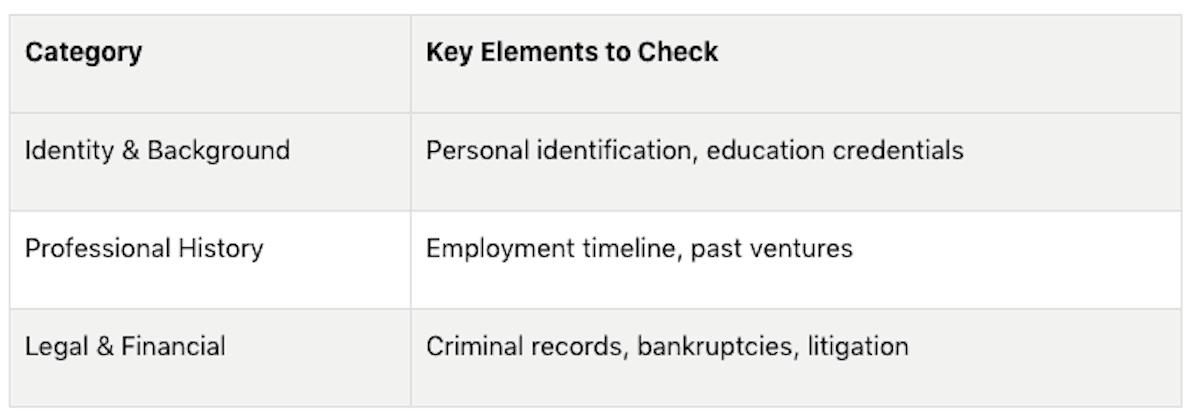

Start with Basic Screening

Start by verifying essential details like identity, employment history, and education. Tools such as Checkr and Certn can help with this initial step [9]. This stage is all about confirming foundational information and spotting any obvious issues before moving on to a more detailed investigation.

AI-powered platforms like TRACT can speed up this process by scanning vast datasets, pulling data from over 9,500 sources, and identifying potential concerns early.

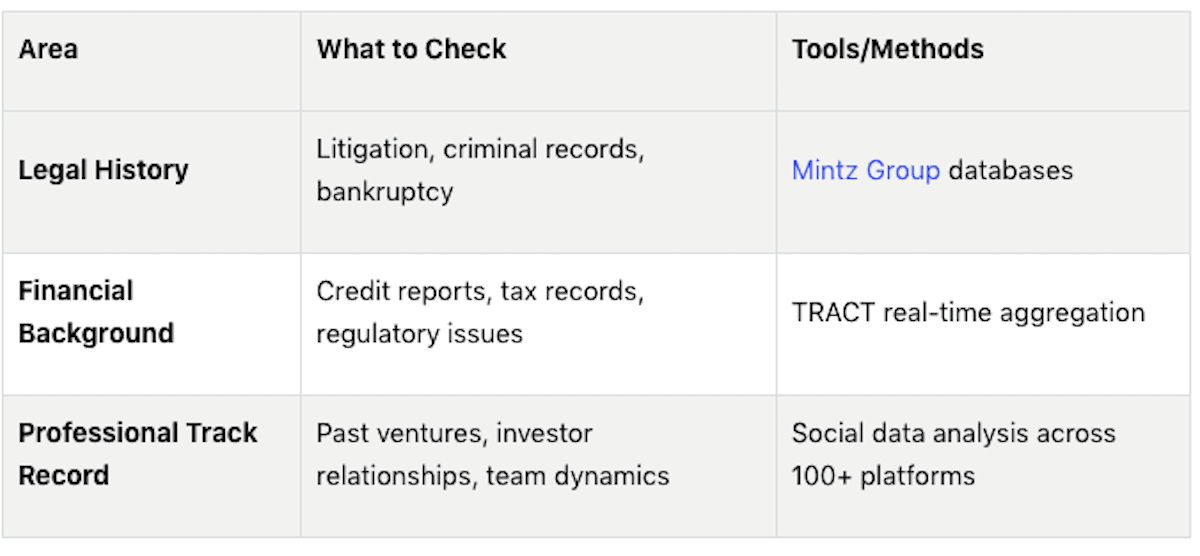

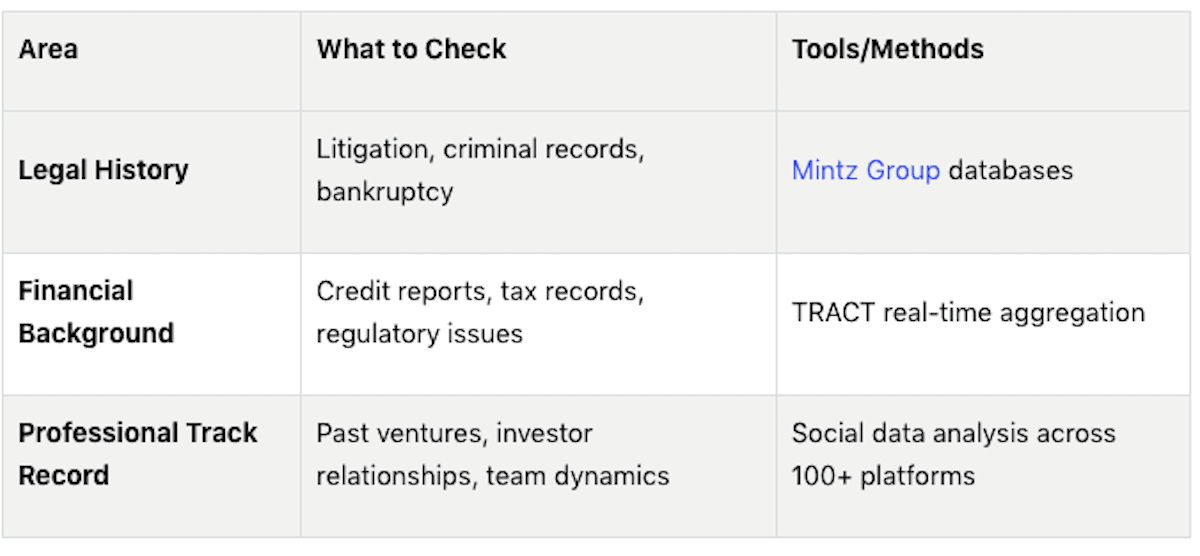

Conduct a Deep Dive

After the basics, it's time to dig deeper into legal, financial, and professional backgrounds. Focus on these three main areas:

Tailor the Process to the Investment

Adapt your background check process to fit the specific investment scenario. Consider these factors:

Industry Requirements: Sectors like fintech or healthcare often demand stricter compliance checks.

Investment Stage: Later-stage startups need deeper evaluations due to larger investments, more complex structures, longer histories, and multiple stakeholders.

Risk Profile: High-risk ventures might call for international checks and verification of regulatory compliance [*].

AI platforms like TRACT offer flexibility, letting you adjust the depth and scope of checks based on the industry's needs, the startup's stage, and the associated risks. While customizing your approach can make your due diligence more thorough, adding input from experts will further improve accuracy.

Tips for Better Background Checks in Venture Capital

AI tools have made background checks faster and easier, but these tips can help you take your due diligence process to the next level.

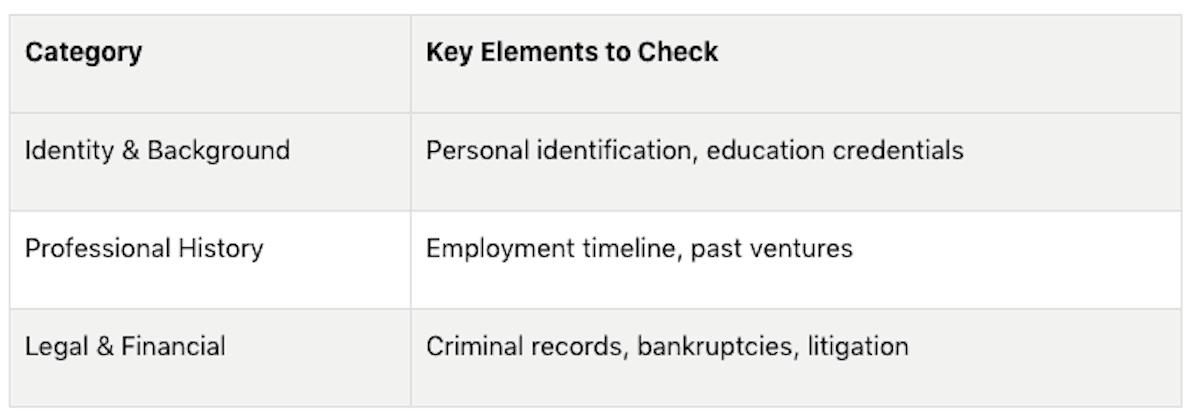

Use a Standardized Checklist

A detailed checklist ensures you don't miss any important details during due diligence. It also helps keep the process consistent across various investments while allowing for adjustments based on industry specifics

While a checklist keeps things organized, pairing it with AI tools and human insight adds depth and accuracy to your findings.

Combine AI Tools with Human Expertise

AI tools can handle large-scale data collection efficiently, but human judgment is essential for interpreting complex findings. Take Genpact's use of Amazon Bedrock, for instance - it cut manual effort by 75%, yet human input was still needed to ensure accuracy [*].

When using AI tools like TRACT, consider these steps:

Use AI to gather and process extensive data.

Let experts review flagged issues for deeper analysis.

Factor in industry-specific insights to evaluate risks effectively.

Comprehensive background checks are critical for spotting potential red flags and making well-informed investment choices [*][*]. Start with AI tools like TRACT for broad data screening, then rely on human expertise to dig into nuanced findings and evaluate character references. This balanced approach ensures you're both efficient and thorough in your venture capital evaluations.

Conclusion: Smarter Investment Decisions with Background Checks

AI-driven tools have revolutionized how due diligence is conducted, shifting it from a manual task to a process powered by data. Platforms like TRACT integrate automation with in-depth data analysis, striking a balance between advanced technology and human expertise.

The benefits of AI in venture capital due diligence are undeniable. For example, Genpact's AI systems reduced manual work by 75%, boosted accuracy by 80%, and achieved complete validation. This shows how venture capitalists can perform quicker, more precise background checks while minimizing costly mistakes.

To improve venture capital background checks:

Use AI tools alongside expert analysis for a well-rounded approach

Ensure thorough checks across legal, financial, and professional areas

Leverage data insights while maintaining human judgment for complex evaluations [*][*]

Interested in learning more about how TRACT can make your due diligence faster and smarter? Schedule a demo.

FAQs

What is the screening process in venture capital?

The screening process in venture capital involves assessing factors like product-market fit, leadership qualifications, financial health, and potential risks. This process blends AI tools with human judgment to ensure thorough due diligence. Many venture capital firms now use AI-powered platforms to make this process faster and more precise, while still relying on human oversight for complex decisions.

AI tools help by flagging issues such as false credentials, legal problems, or ethical concerns. These platforms analyze large datasets to uncover insights that support human evaluations, allowing firms to make better-informed investment decisions and meet regulatory standards.

"Background checks provide critical information about potential investments, helping firms identify risks and opportunities. By conducting thorough background checks, firms can make more informed decisions and reduce the risk of investment failures" [*][*].

How to Conduct Effective Background Checks in Venture Capital

In venture capital, background checks are essential for making informed investment decisions and avoiding risks. Here's how to do it effectively:

Use AI Tools: Platforms like TRACT analyze vast datasets quickly, covering legal, financial, and professional histories.

Key Checks: Verify founders' credentials, check for legal issues, assess financial stability, and review past ventures.

Steps:

Start with basic screening (identity, employment, education).

Conduct a deep dive into legal, financial, and professional backgrounds.

Tailor checks based on industry, investment stage, and risk profile.

Combine AI with Human Expertise: AI speeds up data collection and analysis, but human judgment is crucial for interpreting findings.

AI-driven tools save time, improve accuracy, and uncover potential risks, while human insights ensure thorough evaluations. This approach helps VCs make smarter, safer investments.

Crucial Early Stage Startup Checks: A VC's Guide to Due Diligence

Key Goals of Background Checks in Venture Capital

Background checks in venture capital combine traditional methods with advanced AI tools to thoroughly assess investment opportunities.

Evaluating Founders and Leadership Teams

Tools like TRACT provide detailed insights into founders' professional history, educational background, industry standing, and leadership approach. By analyzing vast amounts of data quickly and precisely, these platforms help investors confirm vital details while saving time and effort compared to manual checks.

Identifying Potential Risks

Critical risk areas include legal troubles (like lawsuits or regulatory breaches), financial issues (such as bankruptcy or misconduct), reputational concerns (e.g., unethical behavior), and regulatory warnings (like sanctions or watchlist entries). AI solutions like Ferretly scan public records to detect risks that traditional methods might overlook [*].

These AI-driven tools not only simplify risk detection but also lay the groundwork for more thorough due diligence, which will be discussed in the next section.

How AI Tools Improve Background Checks

AI-driven tools have reshaped background checks in venture capital, making the due diligence process faster and more thorough.

What AI Brings to Background Checks

AI tools can sift through massive amounts of data from sources like public records, social media, professional networks, and legal databases. This helps create a more complete picture of potential investments. These systems are also capable of spotting subtle patterns or warning signs that might go unnoticed in traditional checks.

For instance, TRACT uses artificial intelligence to scan millions of records, flagging discrepancies in founders' credentials or connections across various databases [*].

Benefits of AI Tools in Background Checks

AI tools bring several key advantages to venture capital firms:

TRACT: A Leading AI Platform for Background Checks

TRACT is a standout AI-powered platform designed for background checks. It provides venture capitalists with access to over 100 billion records from thousands of sources. Key features include:

Real-time legal data aggregation, covering criminal history, legal filings, and bankruptcy records

Social media analysis spanning more than 100 platforms

Detailed employment and education verification

Secure, in-depth reporting tailored for decision-makers

Interested in learning more about how TRACT can make your due diligence faster and smarter? Schedule a demo.

Steps to Perform Effective Background Checks

Start with Basic Screening

Start by verifying essential details like identity, employment history, and education. Tools such as Checkr and Certn can help with this initial step [9]. This stage is all about confirming foundational information and spotting any obvious issues before moving on to a more detailed investigation.

AI-powered platforms like TRACT can speed up this process by scanning vast datasets, pulling data from over 9,500 sources, and identifying potential concerns early.

Conduct a Deep Dive

After the basics, it's time to dig deeper into legal, financial, and professional backgrounds. Focus on these three main areas:

Tailor the Process to the Investment

Adapt your background check process to fit the specific investment scenario. Consider these factors:

Industry Requirements: Sectors like fintech or healthcare often demand stricter compliance checks.

Investment Stage: Later-stage startups need deeper evaluations due to larger investments, more complex structures, longer histories, and multiple stakeholders.

Risk Profile: High-risk ventures might call for international checks and verification of regulatory compliance [*].

AI platforms like TRACT offer flexibility, letting you adjust the depth and scope of checks based on the industry's needs, the startup's stage, and the associated risks. While customizing your approach can make your due diligence more thorough, adding input from experts will further improve accuracy.

Tips for Better Background Checks in Venture Capital

AI tools have made background checks faster and easier, but these tips can help you take your due diligence process to the next level.

Use a Standardized Checklist

A detailed checklist ensures you don't miss any important details during due diligence. It also helps keep the process consistent across various investments while allowing for adjustments based on industry specifics

While a checklist keeps things organized, pairing it with AI tools and human insight adds depth and accuracy to your findings.

Combine AI Tools with Human Expertise

AI tools can handle large-scale data collection efficiently, but human judgment is essential for interpreting complex findings. Take Genpact's use of Amazon Bedrock, for instance - it cut manual effort by 75%, yet human input was still needed to ensure accuracy [*].

When using AI tools like TRACT, consider these steps:

Use AI to gather and process extensive data.

Let experts review flagged issues for deeper analysis.

Factor in industry-specific insights to evaluate risks effectively.

Comprehensive background checks are critical for spotting potential red flags and making well-informed investment choices [*][*]. Start with AI tools like TRACT for broad data screening, then rely on human expertise to dig into nuanced findings and evaluate character references. This balanced approach ensures you're both efficient and thorough in your venture capital evaluations.

Conclusion: Smarter Investment Decisions with Background Checks

AI-driven tools have revolutionized how due diligence is conducted, shifting it from a manual task to a process powered by data. Platforms like TRACT integrate automation with in-depth data analysis, striking a balance between advanced technology and human expertise.

The benefits of AI in venture capital due diligence are undeniable. For example, Genpact's AI systems reduced manual work by 75%, boosted accuracy by 80%, and achieved complete validation. This shows how venture capitalists can perform quicker, more precise background checks while minimizing costly mistakes.

To improve venture capital background checks:

Use AI tools alongside expert analysis for a well-rounded approach

Ensure thorough checks across legal, financial, and professional areas

Leverage data insights while maintaining human judgment for complex evaluations [*][*]

Interested in learning more about how TRACT can make your due diligence faster and smarter? Schedule a demo.

FAQs

What is the screening process in venture capital?

The screening process in venture capital involves assessing factors like product-market fit, leadership qualifications, financial health, and potential risks. This process blends AI tools with human judgment to ensure thorough due diligence. Many venture capital firms now use AI-powered platforms to make this process faster and more precise, while still relying on human oversight for complex decisions.

AI tools help by flagging issues such as false credentials, legal problems, or ethical concerns. These platforms analyze large datasets to uncover insights that support human evaluations, allowing firms to make better-informed investment decisions and meet regulatory standards.

"Background checks provide critical information about potential investments, helping firms identify risks and opportunities. By conducting thorough background checks, firms can make more informed decisions and reduce the risk of investment failures" [*][*].

Unlock the Power of Advanced People Research

Elevate your decision-making with real-time, comprehensive data, transforming data into your most valuable asset. Begin with TRACT today and ensure every decision is backed by unmatched precision.

Schedule a Demo

Unlock the Power of Advanced People Research

Elevate your decision-making with real-time, comprehensive data, transforming data into your most valuable asset. Begin with TRACT today and ensure every decision is backed by unmatched precision.

Schedule a Demo

Unlock the Power of Advanced People Research

Elevate your decision-making with real-time, comprehensive data, transforming data into your most valuable asset. Begin with TRACT today and ensure every decision is backed by unmatched precision.

Schedule a Demo

Unlock the Power of Advanced People Research

Elevate your decision-making with real-time, comprehensive data, transforming data into your most valuable asset. Begin with TRACT today and ensure every decision is backed by unmatched precision.

Schedule a Demo