Jun 10, 2024

Venture Capital

Legal AI startup Harvey is considering raising a $600 million funding round at a $2 billion valuation, with plans to acquire legal research firm vLex.

AI-driven cybersecurity platform Seven AI has emerged from stealth mode, securing a $36 million seed round led by Greylock.

Unify, a platform that identifies the best large language model (LLM) for each prompt, has raised an $8 million funding round, with investments from Y Combinator, Essence, A Capital, and others.

Browserbase, an AI-centric, headless web browser API, has raised a $6.5 million seed round led by Kleiner Perkins.

Retail SaaS startup Dealt has closed a $6.6 million Series A funding round, led by La Poste Ventures and Go Capital.

Private Equity

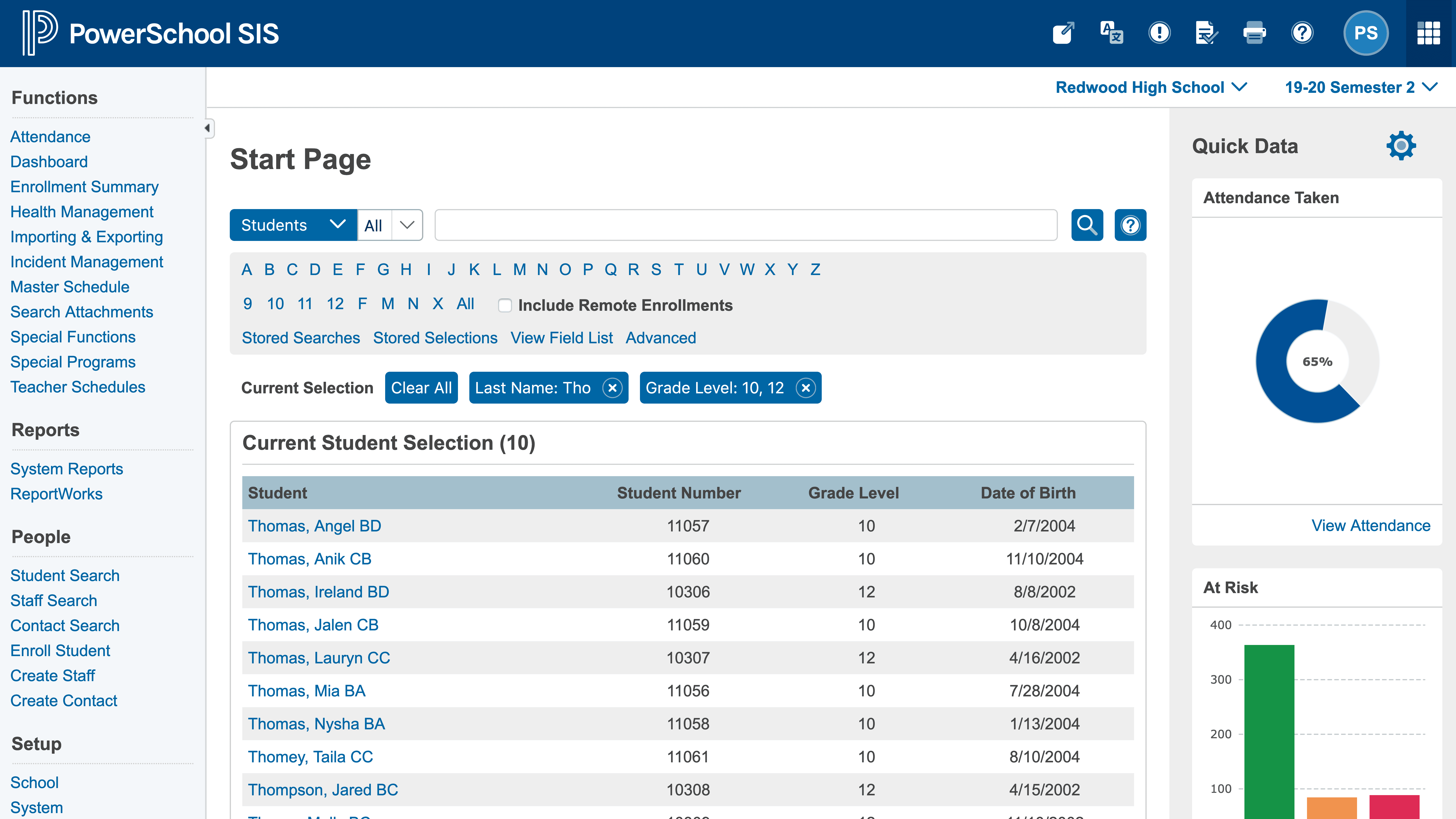

Bain Capital has agreed to take education software firm PowerSchool private in a $5.6 billion cash deal, including debt.

The EU will investigate UAE-controlled telecoms group e&'s proposed $2.4 billion acquisition of Czech PPF Group’s telecom assets in Eastern Europe.

Marketing SEO software firm Yext, with a market cap of approximately $650 million, is exploring a sale following interest from potential buyers.

Private equity firm TDR Capital will acquire Zuber Issa's 22.5% stake in UK supermarket chain Asda for an estimated $636 million, increasing its majority stake to 67.5%.

Digital asset marketplace Bakkt, which has a market cap of $255 million, is exploring a potential sale.

Fidelity and Singapore's Temasek have acquired a $200 million stake in Indian eyewear retailer Lenskart, valuing the company at $5 billion.

Italian bad loan manager doValue will acquire its rival Gardant in a cash-and-stock deal.

LatAm financial services firm Banco BTG Pactual is nearing a deal to acquire a wealth-management bank in New York.

IPO

Gamestop announced a stock offering valued at over $3 billion.

Health-care payments software maker Waystar's shares fell 3.7% in its trading debut after its $968 million IPO, the largest by a US company this year.

India's Bajaj Housing Finance, a subsidiary of non-bank lender Bajaj Finance, has filed for a local IPO to raise up to $838 million.

SoftBank-backed South Korean travel app Yanolja is targeting a $400 million US IPO in July, aiming for a valuation of up to $9 billion.

Walgreens Boots Alliance has shelved plans for a potential IPO of its UK drugstore chain Boots.

New Funds

UK investment firm Aquiline Capital Partners has raised $3.4 billion for its fifth private equity fund and a continuation fund.

Harlan Capital has raised $130 million for a new private credit fund to support companies in the media and telecom sectors.