Jun 13, 2024

Venture Capital

Alzheon, an 11-year-old company based in Framingham, MA, developing treatments for Alzheimer's disease, secured a $100 million Series E funding round, led by Alerce Medical Technology Partners.

Apex, a two-year-old Los Angeles startup specializing in designing and manufacturing standardized satellite buses for space missions, raised $95 million in a round co-led by XYZ Venture Capital and CRV. Additional investors included Upfront, 8VC, Toyota Ventures, Point72 Ventures, Mirae Asset Capital, Outsiders Fund, GSBackers, Andreessen Horowitz, Shield Capital, J2 Ventures, Ravelin, and Avalon Capital Group.

Black Semiconductor, a five-year-old German startup integrating graphene-based photonic interconnects for faster, energy-efficient, and scalable chip fabrics, raised $275 million in Series A funding. The round consisted of $247 million from Germany’s federal government and North Rhine-Westphalia, and $28 million from equity investors Porsche Ventures, Project A Ventures, Scania Growth, Capnamic, Tech Vision Fonds, and NRW.BANK. Previous investors Vsquared Ventures, Cambium Capital, and Onsight Ventures also participated.

FLO, a 15-year-old Quebec company developing and operating EV charging stations, raised $99.3 million in a Series E round led by Export Development Canada. Other participants included Caisse de dépôt et placement du Québec, Investissement Québec, Business Development Bank of Canada, Energy Impact Partners, and MacKinnon, Bennett & Company.

Canary Speech, an eight-year-old startup from Provo, UT, offering a platform that helps healthcare providers, payers, and patients identify and monitor conditions like anxiety, stress, and depression through conversational speech analysis, raised $13 million in a Series A round led by Cortes Capital, with participation from Sorenson Communications, SMK, and Hackensack Meridian Health.

Daisy, a one-year-old startup based in Costa Mesa, CA, specializing in upgrading spaces with smart lighting, security, audio-visual systems, and Wi-Fi for homeowners and AMBs, raised $11 million in a Series A round co-led by Goldcrest and Bungalow. Bullish and Burst Capital also invested.

ElectronX, a Chicago startup operating a financial exchange for the electricity market, raised $15 million in seed funding from Innovation Endeavors, with contributions from DCVC, Amplo, BoxGroup, and Lightning Capital.

Gorilla, a six-year-old Antwerp startup assisting energy companies with pricing, forecasting, and portfolio analysis, raised $24.9 million in a Series B round led by Headline, with previous investors Beringea and PMV also participating.

Grayce, a five-year-old San Francisco startup providing a family care management platform to help users navigate healthcare, financial, and logistical challenges with personalized care plans and support resources, raised $10.4 million in a Series A round led by Maveron. Other investors included BBG Ventures, Correlation Ventures, GingerBread Capital, Alumni Ventures, Visible Ventures, Gaingels, and What If Ventures.

Parity, an eight-year-old Toronto startup offering remote optimization and control of HVAC systems for multifamily residential buildings and hotels, raised $19 million in a Series B round led by Idealist Capital. ArcTern Ventures, Wyse Meter Solutions, and RET Ventures also contributed.

Particle, a one-year-old San Francisco startup offering an AI-powered news reader that curates and personalizes news content for users, raised $10.9 million in a round led by Lightspeed Venture Partners, with Axel Springer also investing.

Alida Biosciences, a four-year-old San Diego startup creating tools for epigenomic research to study RNA modifications in clinical samples, raised $7.5 million in a Series A round led by Genoa Ventures, with FusionX Ventures and Vertical Venture Partners also participating.

Arya, a two-year-old San Francisco and New York startup using artificial intelligence to provide personalized advice on intimacy and offer tailored experiences, raised $7.5 million in a seed round co-led by Patron and Play Ventures, with At.inc and Heracles Capital also joining.

Ava Protocol, a three-year-old San Francisco startup whose crypto product features super-transactions that combine multiple smart contract calls into single operations, raised $10 million in a seed round. Investors included Electric Capital, Taisu Ventures, Bloccelerate VC, BingX Exchange, Shima Capital, Greylock, Foundation Capital, and GSR.

BlinqIO, a one-year-old Wilmington, DE startup using AI to automate software testing, raised $5 million in a round led by Flint Capital, with Inovia Capital also contributing.

Linq, a two-year-old Cambridge, MA startup using AI to simplify research for financial analysts by providing access to financial documents, earnings call transcriptions, and market data, raised $6.6 million in a round co-led by InterVest and Atinum, with participation from TechStars, Kakao Ventures, Smilegate Investment, and Yellowdog.

Pyte, a four-year-old Los Angeles startup enabling companies in highly regulated industries like finance and healthcare to perform computations on encrypted data without decryption, raised $5 million in a round led by Myriad Venture Partners, with contributions from Innovation Endeavors, Liberty Mutual Strategic Ventures, and Pillar VC. The company has raised a total of $12 million.

Restate, a two-year-old Berlin startup enabling developers to create, manage, and run workflows and event-driven applications using durable async/await programming models, raised $7 million in a seed round led by Redpoint Ventures, with Firstminute and Essence VC also investing.

Rivia, a two-year-old Swiss startup providing data analytics tools for biotech companies to manage and analyze clinical trial data, raised $3.2 million in a seed round led by Speedinvest, with Amino Collective and Nina Capital also joining.

Ship Angel, a one-year-old New York startup offering AI tools for managing shipping rates, auditing invoices, and identifying discrepancies in shipping contracts, raised $5 million in a round co-led by Glasswing Ventures and Newark Venture Partners, with participation from Bienville Capital, Socil Capital, and Plug and Play.

Symbiotic, a startup enabling users to reuse staked assets to secure multiple blockchain networks simultaneously, raised $5.8 million in a round co-led by Paradigm and cyber.Fund.

Private Equity

Hellman & Friedman, TPG, and Vista Equity Partners are among the remaining bidders for Aareon, the software business of Advent-owned Aareal Bank, which could fetch an equity value of over $3.2 billion.

Shell has emerged as the lead bidder to acquire LNG assets from Temasek-owned Pavilion Energy, which is seeking over $2 billion.

Oil producer Matador Resources has agreed to purchase assets in the Permian Basin from an EnCap Investments portfolio company for $1.9 billion in cash.

Probiotics maker Seed Health is exploring a sale with a valuation exceeding $1 billion.

Australia's Qantas Airways will acquire the remaining 49% stake in online travel firm TripADeal for $140 million.

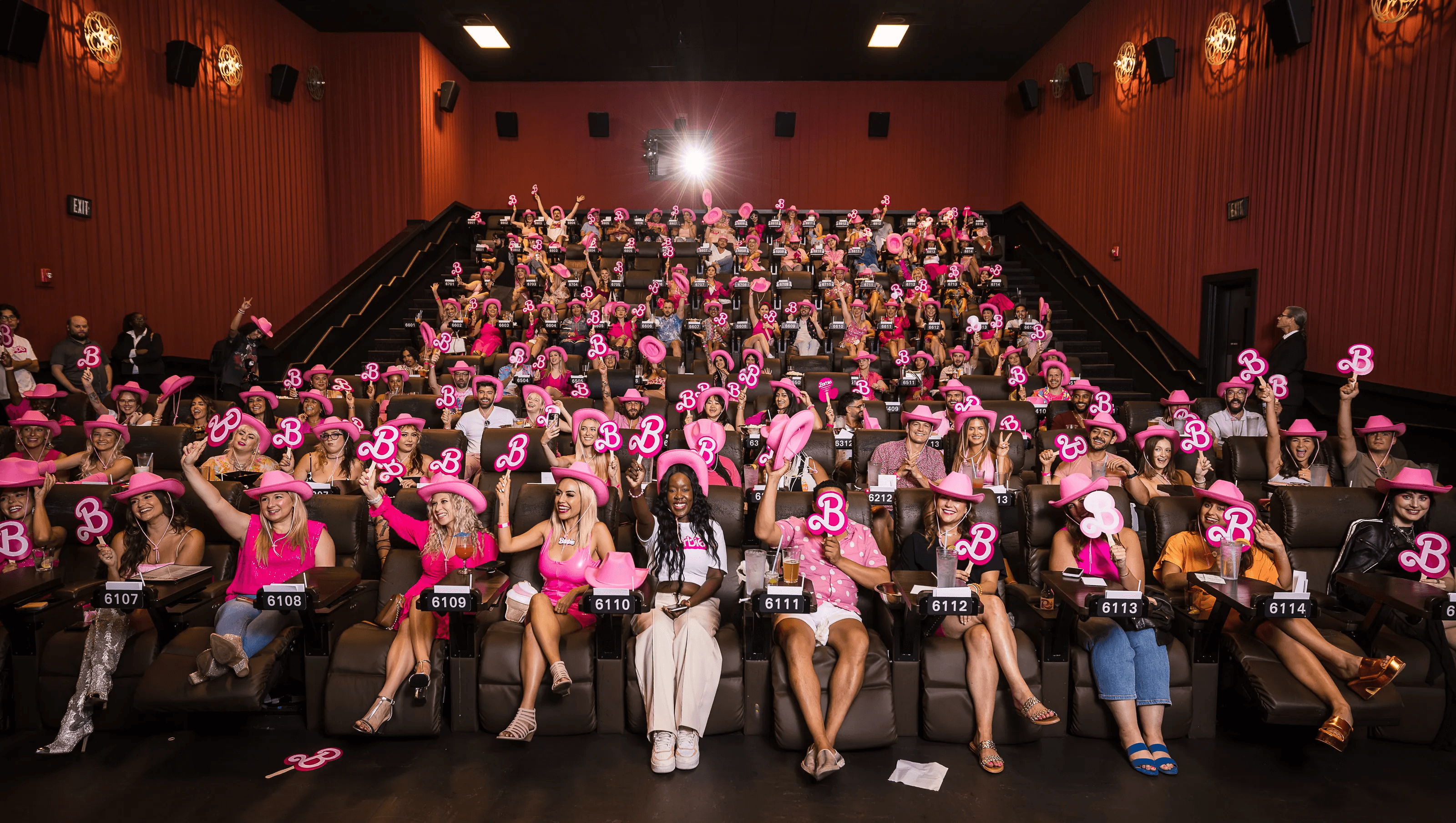

Sony Pictures Entertainment has acquired the dine-in theater chain Alamo Drafthouse Cinema.

Canada is looking to sell a 30% stake in the newly expanded Trans Mountain pipeline system to indigenous owners.

SK Telecom’s AI chip startup unit, Sapeon Korea, has agreed to merge with rival Rebellions.

IPO

Indian snack maker Haldiram's is considering a local IPO after being dissatisfied with its ~$8 billion valuation in recent sales talks.

GameStop has completed a $2.1 billion at-the-market share offering.

Alef Education saw its shares slide approximately 13% in its trading debut following a $515 million IPO in Abu Dhabi.

Apollo Global and other investors are seeking to raise up to $500 million through a US IPO of Mexican airline Grupo Aeroméxico.

The UK's Special Opportunities REIT has pulled its London IPO after failing to meet the $320 million minimum demand requirement.

Swedish esports company NIP Group has filed for an approximately $50 million US IPO.

UAE hospital group NMC Healthcare has appointed Rothschild to advise on strategic options, including a potential IPO.

New Funds

Foresite Capital, a 13-year-old venture capital firm with offices in the San Francisco Bay Area, Los Angeles, and New York, has secured $900 million for a new fund dedicated to supporting startups utilizing AI in healthcare and life sciences.

NorthWall Capital has raised $710 million for its second flagship European private credit fund.

French private equity firm Parquest has raised approximately $450 million for its third fund.