Jun 12, 2024

Venture Capital

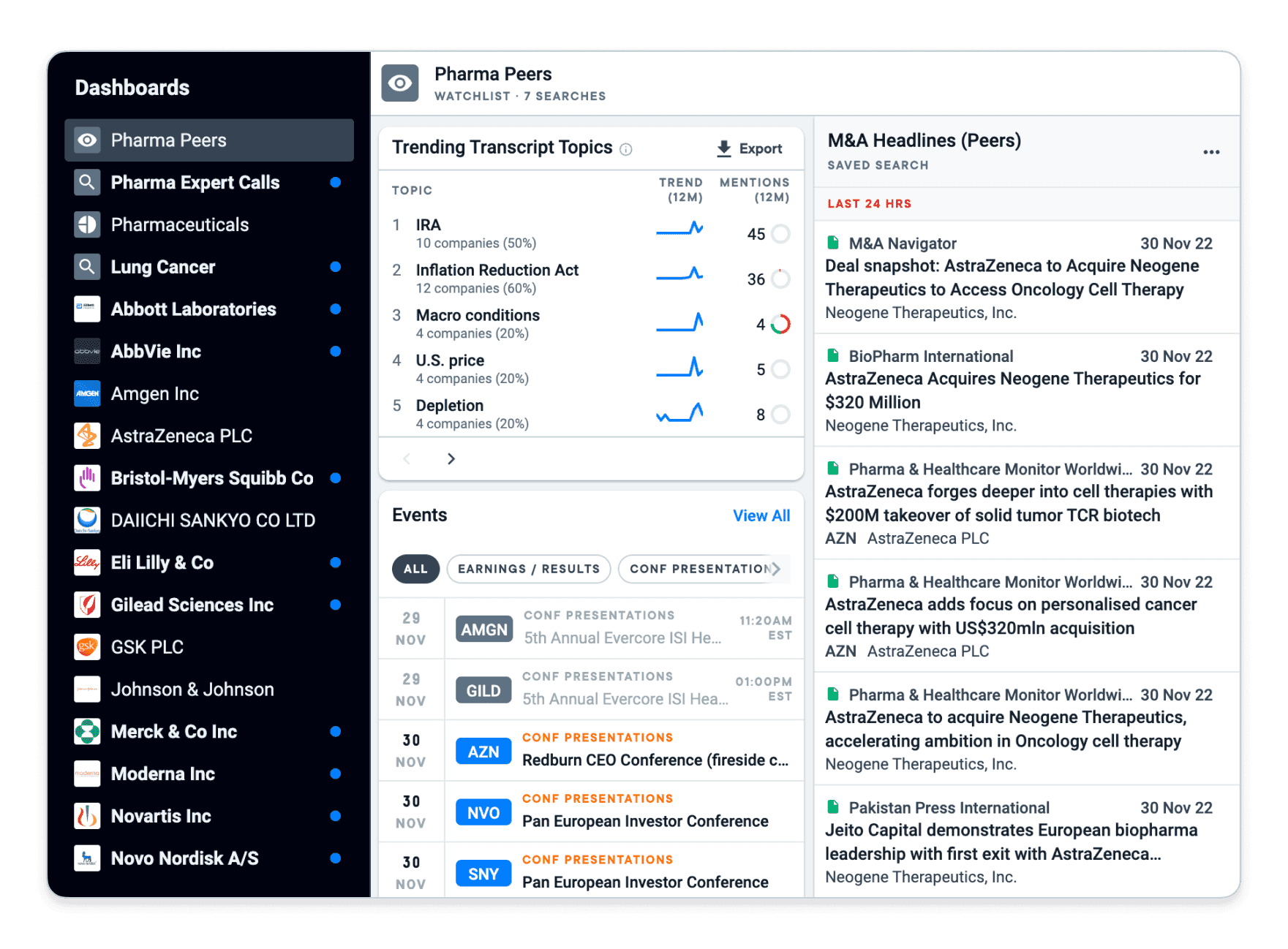

AlphaSense: The New York-based AlphaSense, a 16-year-old AI-driven business insights company, raised $650 million at a $4 billion valuation. The funding round was co-led by Viking Global Investors and BDT & MSD Partners, with participation from J.P. Morgan Growth Equity Partners, SoftBank, Blue Owl, Alkeon Capital, and previous investors CapitalG and Goldman Sachs Alternatives. Additionally, AlphaSense acquired Tegus in a deal worth $930 million.

Battery Smart: Battery Smart, a five-year-old Indian startup specializing in battery-swapping networks for electric two-wheelers and three-wheelers, secured $65 million in a Series B round. The round was led by LeapFrog Investments, with contributions from MUFG Bank, Panasonic, Ecosystem Integrity Fund, Blume Ventures, and British International Investment.

Cognigy: The Düsseldorf-based Cognigy, an eight-year-old startup focused on automating customer support through conversational AI, raised $100 million in a Series C round led by Eurazeo. Insight Partners, DTCP, and DN Capital also participated, bringing the company's total funding to $175 million.

Cyberhaven: Cyberhaven, an eight-year-old Palo Alto startup that helps companies monitor data usage and prevent unauthorized sharing, raised $88 million at a $488 million valuation. The round was led by Adams Street Partners, with Khosla Ventures also participating.

Mistral AI: Paris-based Mistral AI, a one-year-old startup developing open-source large language models (LLMs) to rival OpenAI, raised $500 million in equity and $140 million in debt, valuing the company at $6 billion. The funding was co-led by DST Global and General Catalyst, with investments from Lightspeed Venture Partners, Andreessen Horowitz, Nvidia, Samsung, Salesforce Ventures, and several others.

Astrocade: Astrocade, a two-year-old San Francisco startup enabling users to create AI-powered games and interactive experiences, raised a $12 million seed round. Investors included AME Cloud Ventures, NVIDIA Ventures, Venture Reality Fund, and angel investors like Eric Schmidt, John Riccitiello, Jerry Yang, and Mike Abbott.

Moleculent: Stockholm's Moleculent, a startup developing advanced cellular analysis tools, raised $26 million in a Series A round co-led by ARCH Venture Partners and Eir Ventures.

Nexus Laboratories: Nexus Laboratories, a two-year-old San Francisco startup using zero-knowledge proofs to verify computations without revealing data, raised $25 million in a Series A round co-led by Lightspeed Venture Partners and Pantera Capital. Dragonfly Capital, Faction Ventures, and Blockchain Builders also participated.

Tenderd: Dubai-based Tenderd, a six-year-old startup with an AI-powered analytics platform for fleet optimization, raised $30 million in a Series A round led by A.P. Moller Holding. Quadri Ventures and previous investors Wa’ed Ventures, Nakhla Ventures, SOMA Capital, Liquid 2 Ventures, Peter Thiel, Paul Graham, and Y Combinator also joined.

Whoosh: Whoosh, a four-year-old Mill Valley, CA startup offering cloud-based software for managing golf clubs and similar venues, raised $10.3 million in a Series A round led by AlleyCorp. Investors included 8VC, Alaris Capital, Bienville, Craft Ventures, Eberg Capital, Operator Partners, and Raptor Group.

XONA: XONA, a seven-year-old Annapolis, MD startup providing secure remote access to critical infrastructure for energy and manufacturing sectors, raised $18 million. The round was led by Energy Impact Partners, bringing the company's total funding to $32 million.

Brightwave: Brightwave, a one-year-old startup based in New York and Boulder, CO, offering an AI-powered financial research assistant, raised $6 million in a seed round led by Decibel Partners, with Point72 Ventures and Moonfire Ventures also participating.

EvodiaBio: EvodiaBio, a three-year-old Copenhagen startup providing natural scents to enhance non-alcoholic beer flavors, raised $7.5 million. The Export & Investment Fund of Denmark and The March Group co-led the funding round.

FirmPilot: Miami-based FirmPilot, a one-year-old startup offering AI-driven marketing tools for law firms and service-based small businesses, raised $7 million in a Series A round led by Blumberg Capital. Valor Ventures, SaaS Ventures, FJ Labs, and Connexa Capital also invested.

Jump: Jump, a one-year-old Salt Lake City startup using AI to help financial advisors manage investments and financial planning, raised $4.6 million in a seed round led by Sorenson Capital, with participation from Pelion Venture Partners.

Mountain Protocol: Bermuda-based Mountain Protocol, a one-year-old startup offering a stablecoin backed by short-term U.S. Treasuries with a 5% annual yield, raised $8 million in a Series A round led by Multicoin Capital. Castle Island Ventures and Coinbase Ventures also invested.

Whizz: Whizz, a four-year-old New York startup providing electric bike rentals for delivery riders, raised $5 million in a Series A round led by LETA Capital, with Flashpoint contributing an additional $7 million in debt. The company has raised a total of $20 million.

Zeliq: Paris-based Zeliq, a one-year-old startup offering an AI-powered platform for lead generation and engagement, raised $10 million in a seed round led by Exor Ventures, with Resonance VC also participating. The company has raised a total of $15.4 million.

Private Equity

Clayton Dubilier & Rice: Private equity firm Clayton Dubilier & Rice has emerged as the frontrunner to acquire German drugmaker Stada Arzneimittel from its owners, Bain and Cinven, who are seeking $11.8 billion.

National Amusements: Shari Redstone's National Amusements, which controls the $7.7 billion Paramount Global, has ended acquisition talks with David Ellison's Skydance Media.

National Bank of Canada: National Bank of Canada will acquire rival Canadian Western Bank in a stock deal valued at approximately $3.6 billion.

Edgar Bronfman Jr.: Bain-backed media executive Edgar Bronfman Jr. is considering a bid of up to $2.5 billion for Shari Redstone's National Amusements, which controls the $7.7 billion Paramount Global.

KKR: KKR will acquire a significant minority stake in Quick Quack Car Wash for $850 million.

Whitestone REIT: Commercial real estate company Whitestone REIT, with a market cap of $653 million, has rejected a takeover proposal from MCB Real Estate.

Voodoo: App developer Voodoo will acquire social media platform BeReal for $537 million.

Eni: Italian oil company Eni has begun the sale of a 10% stake in offshore drilling services company Saipem, valued at $440 million.

IAG and Air Europa: British Airways parent company IAG has offered new concessions to EU regulators for its $430 million acquisition of Air Europa.

Alten and Atos' Worldgrid Unit: Engineering consultant Alten has entered exclusive negotiations to acquire the debt-laden Worldgrid unit of French tech group Atos for an enterprise value of $290 million.

Mercer: Investment management firm Mercer has agreed to acquire UK pension manager Cardano, which has $66 billion in assets under management.

IPO

Lineage Logistics: Logistics giant Lineage is aiming to raise up to $3.5 billion in a U.S. IPO, potentially launching as soon as July.

Golden Goose: Luxury sneaker brand Golden Goose plans to raise $600 million in what could be Milan’s largest IPO in a year.

Raspberry Pi: Shares of low-cost computer maker Raspberry Pi surged approximately 38% in its trading debut following a $211 million IPO in London.

New Funds

Day One Ventures: Day One Ventures, a six-year-old early-stage venture capital firm known for leading public relations efforts for its portfolio companies, has closed its latest fund with $150 million in capital commitments.

Partners Group: Swiss private markets firm Partners Group has closed its fifth private equity fund, raising over $15 billion.

Vsquared Ventures: Vsquared Ventures, a German early-stage deep tech fund, has successfully closed its second fund at $230 million.

InvestBev: Beverage-focused investor InvestBev has raised $150 million for its fifth private equity fund.